Results of Operations

The following analysis of earnings performance relates to continuing operations as of December 31, 2017. Please refer to the “Performance of the Group Divisions” section for a more detailed picture of the results of operations.

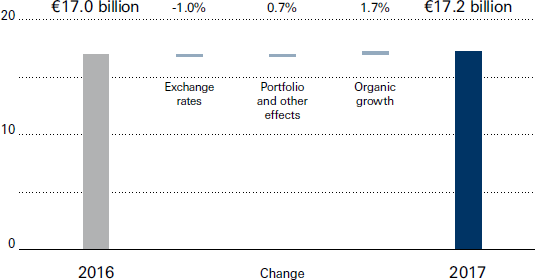

Revenue Development

Group revenues in the financial year 2017 rose by 1.4 percent to €17.2 billion (previous year: €17.0 billion). Revenue increases were recorded in particular at RTL Group, BMG, Arvato and Bertelsmann Education Group. The Group achieved organic growth of 1.7 percent, adjusted for exchange rate and portfolio effects. The exchange rate effects were -1.0 percent and the portfolio effects were 0.7 percent.

Revenues at RTL Group rose 2.2 percent to €6,373 million (previous year: €6,237 million). The organic growth was 1.8 percent. The positive development was mainly generated by the German and French TV businesses and the continued expansion of digital activities. Revenues at Penguin Random House remained stable at €3,359 million (previous year: €3,361 million). Negative exchange rate effects were largely offset by portfolio effects. At €1,513 million, Gruner + Jahr’s revenues were down 4.2 percent year on year (previous year: €1,580 million). The organic growth was -1.6 percent. The revenue decline stems largely from the portfolio effects of disposals. Revenues at BMG increased by 21.8 percent to €507 million (previous year: €416 million) as a result of further acquisitions and organic business expansion. The organic growth was 18.5 percent. Revenues at Arvato rose 1.6 percent to €3,823 million (previous year: €3,763 million). The organic growth was 2.9 percent. This was primarily the result of the growth of business with new and existing customers at SCM Solutions. Revenues at Bertelsmann Printing Group fell 1.6 percent to €1,681 million (previous year: €1,709 million) due to market and exchange rate effects. The organic growth was -1.0 percent. Bertelsmann Education Group increased its revenues by 32.6 percent to €189 million (previous year: €142 million). The organic growth was 12.5 percent. The rise was primarily the result of the organic and acquisitive expansion of Relias. None of the investments of Bertelsmann Investments are fully consolidated.

Revenues by Division

| in € millions | 2017 | 2016 (adjusted) | ||||

|---|---|---|---|---|---|---|

| Germany | Other countries | Total | Germany | Other countries | Total | |

| RTL Group | 2,266 | 4,107 | 6,373 | 2,205 | 4,032 | 6,237 |

| Penguin Random House | 250 | 3,109 | 3,359 | 266 | 3,095 | 3,361 |

| Gruner + Jahr | 964 | 549 | 1,513 | 959 | 621 | 1,580 |

| BMG | 33 | 474 | 507 | 31 | 385 | 416 |

| Arvato | 1,521 | 2,302 | 3,823 | 1,568 | 2,195 | 3,763 |

| Bertelsmann Printing Group | 957 | 724 | 1,681 | 971 | 738 | 1,709 |

| Bertelsmann Education Group | 1 | 188 | 189 | – | 142 | 142 |

| Bertelsmann Investments | – | – | – | – | – | – |

| Total divisional revenues | 5,992 | 11,453 | 17,445 | 6,000 | 11,208 | 17,208 |

| Corporate/Consolidation | (152) | (103) | (255) | (142) | (116) | (258) |

| Continuing operations | 5,840 | 11,350 | 17,190 | 5,858 | 11,092 | 16,950 |

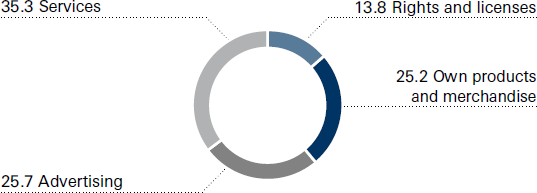

There were only minor changes in the geographical breakdown of revenues compared to the previous year. The share of revenues generated in Germany was 34.0 percent compared to 34.6 percent in the previous year. The revenue share generated by France amounted to 13.4 percent (previous year: 13.2 percent). In the United Kingdom, the revenue share was 6.8 percent (previous year: 6.4 percent). The share of total revenues generated by the other European countries amounted to 18.7 percent compared to 18.3 percent in the previous year. The revenue share generated by the United States was 20.5 percent (previous year: 20.8 percent), and the other countries achieved a revenue share of 6.6 percent (previous year: 6.7 percent). This means that the share of total revenues generated by foreign business was 66.0 percent (previous year: 65.4 percent). Year on year, there was a slight change in the ratio of the four revenue sources (own products and merchandise, advertising, services, rights and licenses) to overall revenue.

The revenue share generated by the growth businesses increased to 32 percent overall (previous year: 30 percent), thanks to organic growth and acquisitions, while the revenue share of structurally declining businesses remained stable at 4 percent (previous year: 4 percent). The growth businesses comprise those activities that post continuous revenue increases due to sustained positive market factors and that have been identified as growth priorities as part of Group strategy. These include the digital businesses of RTL Group and Gruner + Jahr; the TV production, music business and service businesses in the Arvato divisions of SCM Solutions and Financial Solutions and Systems; the education business, and the fund activities. The structurally declining businesses comprise those activities that post sustained revenue losses due to market factors. These include in particular the gravure printing activities and the storage media replication business.

Operating EBITDA

Bertelsmann achieved a 2.7 percent increase in operating EBITDA to €2,636 million in the financial year 2017 (previous year: €2,568 million). In particular, RTL Group, BMG and Bertelsmann Education Group achieved a good earnings performance. The operating EBITDA includes start-up losses for digital and new businesses, which for Bertelsmann Education Group and RTL Group alone totaled €-69 million (previous year: €-71 million). The EBITDA margin increased to 15.3 percent (previous year: 15.2 percent).

Operating EBITDA at RTL Group rose 5.2 percent to €1,478 million (previous year: €1,405 million). In particular, Mediengruppe RTL Deutschland and Fremantle Media posted earnings increases. The earnings figure for RTL Group also includes a profit from the sale of buildings in Paris previously used by RTL Radio France. Operating EBITDA at Penguin Random House declined by 2.9 percent to €521 million (previous year: €537 million), particularly as a result of negative exchange rate effects. Gruner + Jahr’s operating EBITDA increased by 6.2 percent to €145 million (previous year: €137 million). A strong rise in earnings at G+J Deutschland, attributable among other things to the development of digital businesses and positive portfolio effects from disposals, was contrasted by lower contributions to earnings in France. BMG’s operating EBITDA rose by 9.5 percent to €104 million (previous year: €95 million), thanks to the continued development of the business. Operating EBITDA at Arvato declined by 10.0 percent to €320 million (previous year: €356 million). The lower earnings resulted primarily from a fall in the volume of CRM business within the telecommunications sector and from higher start-up losses for new businesses. Operating EBITDA at Bertelsmann Printing Group declined by 2.3 percent to €118 million (previous year: €121 million) due to the persistently declining print market and as a result of negative exchange rate effects. Operating EBITDA at Bertelsmann Education Group increased to €3 million (previous year: €-17 million). This is primarily attributable to the organic growth of Relias. This includes proportional start-up losses from Group investments that are not fully consolidated. None of the investments of Bertelsmann Investments are fully consolidated; therefore, in most cases no operating results are disclosed for this segment.

Results Breakdown

| in € millions | 2017 | 2016 (adjusted) |

|---|---|---|

| Operating EBITDA by division | ||

| RTL Group | 1,478 | 1,405 |

| Penguin Random House | 521 | 537 |

| Gruner + Jahr | 145 | 137 |

| BMG | 104 | 95 |

| Arvato | 320 | 356 |

| Bertelsmann Printing Group | 118 | 121 |

| Bertelsmann Education Group | 3 | (17) |

| Bertelsmann Investments | (3) | – |

| Total operating EBITDA by division | 2,686 | 2,634 |

| Corporate/Consolidation | (50) | (66) |

| Operating EBITDA from continuing operations | 2,636 | 2,568 |

| Amortization/depreciation, impairments/reversals of intangible assets and property, plant and equipment not included in special items | (657) | (630) |

| Special items | (83) | (139) |

| EBIT (earnings before interest and taxes) | 1,896 | 1,799 |

| Financial result | (219) | (244) |

| Earnings before taxes from continuing operations | 1,677 | 1,555 |

| Income tax expense | (472) | (419) |

| Earnings after taxes from continuing operations | 1,205 | 1,136 |

| Earnings after taxes from discontinued operations | (7) | 1 |

| Group profit or loss | 1,198 | 1,137 |

| attributable to: Earnings attributable to Bertelsmann shareholders | 776 | 686 |

| attributable to: Earnings attributable to non-controlling interests | 422 | 451 |

Special Items

Special items in the financial year 2017 totaled €-83 million compared to €-139 million in the previous year. They consist of reversals on impairments and impairment losses totaling €-100 million (previous year: €-26 million), adjustments of carrying amounts of assets held for sale of €-4 million (previous year: €-14 million), fair value remeasurement of investments of €15 million (previous year: €12 million), results from disposals of investments totaling €182 million (previous year: €41 million), and restructuring expenses and other adjustments totaling €-176 million (previous year: €-152 million) (see also the reconciliation of EBIT to operating EBITDA in the notes to the Consolidated Financial Statements). Results from disposals of investments were characterized by gains on disposals at Bertelsmann Investments.

EBIT

EBIT amounted to €1,896 million in the financial year 2017 (previous year: €1,799 million) after adjusting operating EBITDA for special items totaling €-83 million (previous year: €-139 million) and the amortization, depreciation, impairments and reversals of impairments on intangible assets and property, plant and equipment totaling €-657 million (previous year: €-630 million), which were not included in adjustments.

Group Profit or Loss

The financial result improved to €-219 million compared to the previous year’s figure of €-244 million. The income tax expenses came to €-472 million compared to €-419 million in the previous year, in particular due to the improved earnings before taxes from continuing operations and due to burdens in connection with the US tax reform. This produced earnings after taxes from continuing operations of €1,205 million (previous year: €1,136 million). Taking into account the earnings after taxes from discontinued operations of €-7 million (previous year: €1 million), this resulted in a Group profit of €1,198 million (previous year: €1,137 million). The share of Group profit held by non-controlling interests came to €422 million (previous year: €451 million). The share of Group profit held by Bertelsmann shareholders increased to €776 million (previous year: €686 million), particularly as a result of the shareholding increase in Penguin Random House. At the Annual General Meeting of Bertelsmann SE & Co. KGaA , an unchanged yearon- year dividend payout of €180 million will be proposed for the financial year 2017 (previous year: €180 million).