Performance of the Group Divisions

RTL Group

RTL Group once again delivered a very gratifying business performance in 2017. The main drivers were Mediengruppe RTL Deutschland and the French Groupe M6, which managed to increase their advertising revenues in their respective stable TV advertising markets. Rapidly growing digital businesses also contributed to the positive business performance. RTL Group’s ad-tech business was expanded by the full takeover of the online video ad-serving platform SpotX. SpotX and Smartclip started merging into an integrated ad-tech powerhouse. RTL Group expanded its presence on numerous online platforms as part of its “Total Video” strategy, and saw strong growth in online video views.

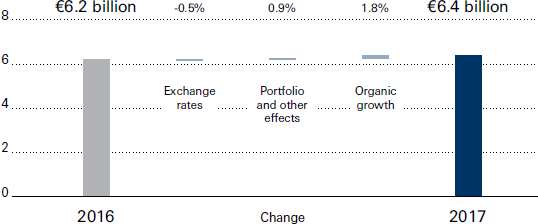

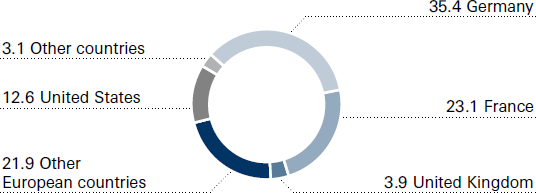

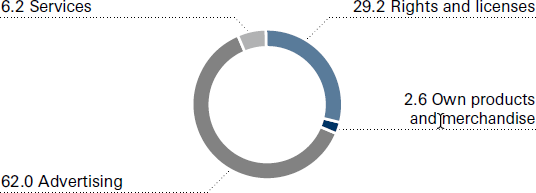

Against this backdrop, RTL Group’s revenues increased by 2.2 percent to a record €6.4 billion (previous year: €6.2 billion). Operating EBITDA also reached a new record, rising 5.2 percent to €1.5 billion (previous year: €1.4 billion). A positive one-off effect from the sale of commercial real estate in France and a higher contribution to earnings from Mediengruppe RTL Deutschland and RTL Group’s production arm Fremantle Media contributed to this. The EBITDA margin increased to 23.2 percent after 22.5 percent in the previous year.

Mediengruppe RTL Deutschland once again ended the financial year with record revenues and earnings. This was fueled by higher advertising revenues from the TV and digital business, as well as growing platform revenues. The combined average audience share of the family of channels increased to 28.9 percent in the main target group (2016: 28.7 percent). At the same time, the group significantly widened its lead over its biggest commercial competitor to 4.5 percentage points (previous year: 3.4 percentage points).

In France, Groupe M6 grew its revenues with higher TV advertising revenues and the first-time consolidation of French cashback market leader iGraal. Earnings decreased slightly as the previous year’s result had included the positive oneoff effect from the gradual expiration of a mobile telephony agreement. RTL Group merged its French radio business, RTL Radio (France), with Groupe M6 in October, enabling a strengthening of its commercial offering as well as program and cost synergies. Groupe M6 achieved a combined TV audience share of 22.3 percent in the main target group (previous year: 22.2 percent). RTL Nederland recorded decreased advertising revenues during the reporting period, resulting in lower revenues and earnings.

Fremantle Media reported slightly lower revenues for 2017 due to negative exchange rate effects, but increased its operating result as a result of higher profit contributions from North America and Europe. Its greatest creative successes included the fantasy series “American Gods,” which was produced by Fremantle Media North America for the US cable channel Starz and has also been available to more than 200 territories since May 2017 through Amazon Prime Video, and UFA Fiction’s historical drama series “Charité,” produced for Das Erste in Germany.

RTL Group continued to invest in its three strategic pillars of broadcasting, content and digital and, in addition to taking full ownership of SpotX, acquired a minority stake in the Israeli virtual-reality company Inception. Mediengruppe RTL Deutschland secured important sports rights to Formula 1 motor racing and UEFA Europa League soccer matches.

Penguin Random House

For Penguin Random House, the 2017 financial year was dominated by changes in the ownership structure, a strong bestseller performance and an expansion of the business in the Spanish-language territories. Bertelsmann increased its shareholding in Penguin Random House to a strategic threequarters majority in October by acquiring another 22 percent from co-shareholder Pearson, thereby strengthening its governance rights. The operating business benefited from hundreds of national and international bestsellers. “Wonder” by R.J. Palacio, its biggest-selling title in 2017 in the United States, received additional impetus through a movie adaptation and sold close to five million copies in print and e-book formats in its English-speaking territories. While print book revenues remained broadly stable overall, and e-book sales declined moderately, Penguin Random House again recorded strong growth in digital audiobooks. In 2017, the book group continued to expand its direct-to-consumer outreach to readers, and also acquired the world publishing rights for two books by former US President Barack Obama and former First Lady Michelle Obama.

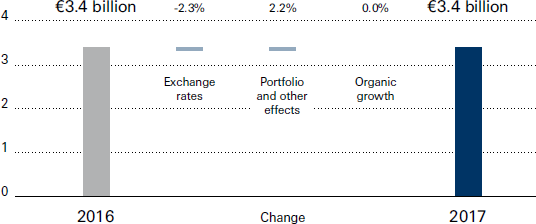

Inclusive of Verlagsgruppe Random House, the German publishing group wholly owned by Bertelsmann, Penguin Random House achieved stable revenues of €3.4 billion in 2017 (previous year: €3.4 billion, -0.1 percent). Negative exchange rate effects were largely offset by portfolio effects. The book group’s operating EBITDA declined by 2.9 percent to €521 million (previous year: €537 million) due to exchange rate effects. The EBITDA margin once again reached the high level of 15.5 percent (previous year: 16.0 percent).

In the United States, Penguin Random House publishers placed 461 titles on the “New York Times” bestseller lists last year, including 61 at number one. In addition to R.J. Palacio’s “Wonder,” the year’s major successes included “Origin” by Dan Brown, “Camino Island” and “The Rooster Bar” by John Grisham and “Into the Water” by Paula Hawkins. Almost ten million copies of children’s book classics by Dr. Seuss were sold.

In the United Kingdom, Penguin Random House UK publishers recorded growth. Titles published by Penguin Random House UK publishers achieved a 43 percent share of “The Sunday Times” top 10 weekly bestseller lists. Top sellers included “5 Ingredients” by Jamie Oliver, “Origin” by Dan Brown, and “Diary of a Wimpy Kid: The Getaway” by Jeff Kinney.

Penguin Random House Grupo Editorial also increased its revenues, benefiting from strong frontlist and backlist sales, which more than offset declining economic development in several Latin American countries. With the acquisition of Ediciones B in July, Penguin Random House Grupo Editorial enhanced its position as the largest publisher in Latin America and its market position in Spain. Its bestselling titles in 2017 were “Una Columna de Fuego” (“A Column of Fire”) by Ken Follett and “Más allá del invierno” (“In the Midst of Winter”) by Isabel Allende.

In Germany, notwithstanding the industry-wide impact of declining consumer traffic in bookstores, Verlagsgruppe Random House maintains its market-leading position. The publishing group had 401 titles on the “Spiegel” bestseller lists, including 22 at number one. “Die Geschichte der Bienen” (“The History of Bees”) by Maja Lunde was the bestselling book in Germany in 2017.

Penguin Random House authors were honored with numerous major international literary awards. Kazuo Ishiguro, who is published by Penguin Random House, won the Nobel Prize in Literature. The publishing group’s authors also received four Pulitzer Prizes, two Man Booker Awards, and a US National Book Award.

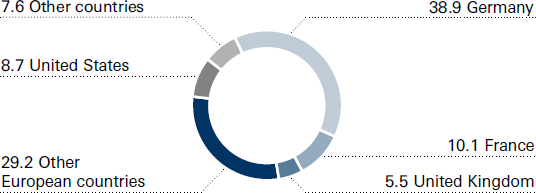

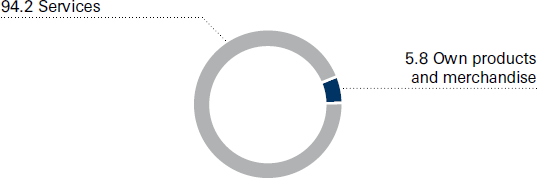

Gruner + Jahr

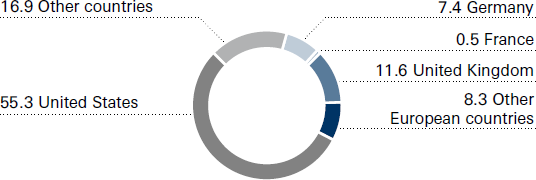

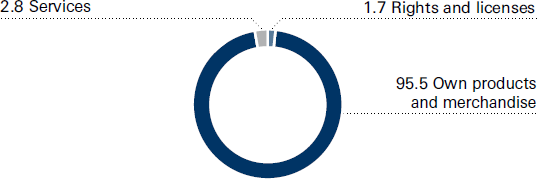

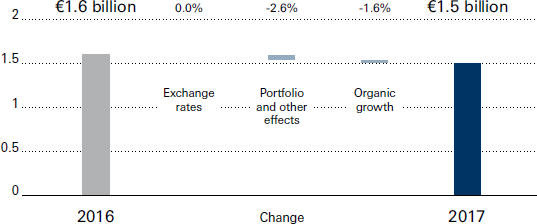

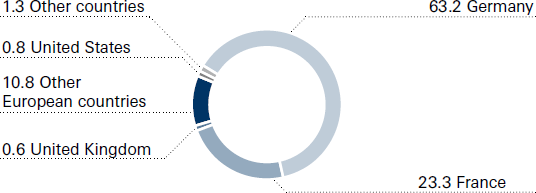

Gruner + Jahr achieved a significantly higher operating result, attributable mainly to the growing German business. Revenues fell by 4.2 percent to €1.5 billion (previous year: €1.6 billion), due to portfolio adjustments, notably the sale of the publishing activities in Spain and Austria. However, growing digital revenues and new business, including new magazines, had a positive impact on earnings. Operating EBITDA improved by 6.2 percent to €145 million (previous year: €137 million), causing the EBITDA margin to rise to 9.6 percent (previous year: 8.7 percent).

G+J grew both its revenues and earnings in Germany. The decline in the print ad-sales business, which was slight compared to the rest of the market, was offset by surging digital revenues. The German sales business also grew in total.

The fast-growing digital business was a major contributor to the good business performance in Germany. The digital share of total revenues in the German core market rose to over a quarter. The AppLike marketing platform, founded in 2016, experienced strong growth. G+J’s most successful online offerings, such as the “Chefkoch” community and the journalistic flagships “Stern,” “Gala” and “Brigitte,” each achieved record reach and revenues in the 2017 financial year.

As in previous years, there were several new magazine launches in 2017, such as “Ideat,” “Hygge” and “Cord.” Another positive contributor were the activities of the Ad Alliance jointly formed by RTL subsidiary IP Deutschland and G+J eMS, which develops cross-genre advertising concepts. “Der Spiegel” was added last year. The content communication agency Territory did well, and the DDV Media Group had a stable financial year in terms of revenues and earnings.

G+J France’s business was dominated by moderate declines in revenues. The earnings fell sharply. In particular, the print advertising business and individual digital businesses came under pressure, including the digital video ad marketer “Advideum.” The journalistic digital offerings of the classic magazine brands such as “Voici,” “Gala” and “Femme actuelle” significantly increased their reach and sales, mainly due to growing revenues in the mobile and video segment. In sum, digital revenues rose year on year.

BMG

Bertelsmann’s music subsidiary BMG significantly grew its publishing and recorded-music business in 2017, expanded its scope to include audiovisual content and continued its international expansion. BMG benefited from the acquisition of the country label BBR Music Group, from prominent artist signings and chart successes, and a continuing upturn in the recorded music industry fueled by streaming and new emerging markets.

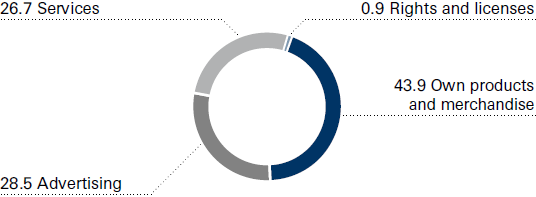

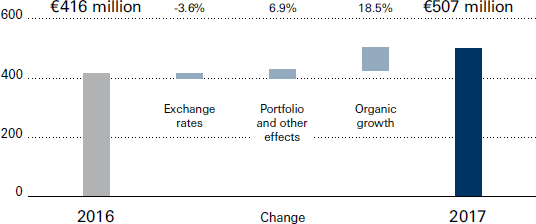

BMG’s revenues increased by 21.8 percent to €507 million (previous year: €416 million). This is attributable to higher revenues across all market segments and regions through organic growth and acquisition, especially in the recorded music business and in the British, US and Australian publishing business. Operating EBITDA also increased due to organic and acquisition-derived growth, rising by 9.5 percent to €104 million (previous year: €95 million). This development was driven by the recording business in the United States as well as by the publishing business in the United Kingdom and United States. The EBITDA margin was 20.5 percent (previous year: 22.8 percent).

BMG expanded its portfolio with a series of purchases and catalog acquisitions. In January, the company acquired the BBR Music Group, which includes the country music labels Broken Bow Records, Stoney Creek Records and Wheelhouse Records, as well as the music publisher Magic Mustang Music. The deal secures BMG a significant position in the country music capital of Nashville – and thus in the lucrative country music market. In September, Chrissie Hynde, founder and singer of the British rock band The Pretenders, entrusted her entire song catalog to BMG. In the recorded-music business, BMG added Nickelback, Morrissey, Avril Lavigne, Fergie, Kylie Minogue and the rapper Kontra K to its artist roster. Further expansion of the recorded music business was accompanied by a strong showing in music publishing, with BMG songwriters responsible for each of the top three songs in the Billboard Hot 100 for 13 consecutive weeks in summer 2017.

The company has strengthened its international footprint with enhanced representation in Canada and an expansion of its activities in China, including an innovative partnership with mobile social network Momo to develop Chinese talent with the help of BMG songwriters.

BMG extended the range of services it offers to artists with an entry into the movie and television business. Its first major production – a documentary about Joan Jett – was selected to premiere at the Sundance Film Festival. Moreover, BMG grouped its production music interests into a new international business unit, focused on commissioning and marketing the rights to music specifically produced for movies, radio, the Internet, video games and advertising.

BMG concluded significant partnership agreements with several major entertainment providers in the reporting period. The company now manages the music publishing rights of RTL Group’s content production arm Fremantle Media, the streaming provider Netflix and the production company Amblin Partners, founded by Hollywood legend Steven Spielberg.

BMG also developed a mobile application called myBMG, which gives artists and songwriters a 24/7 overview of their constantly updated royalty information.

Arvato

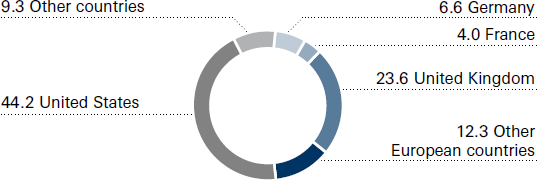

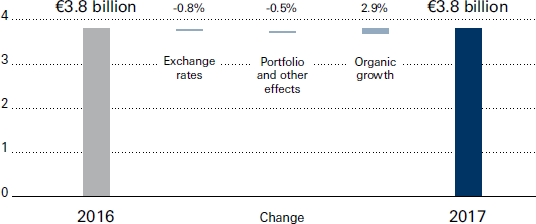

Arvato posted a stable revenue performance and a decline in the operating result in 2017. Arvato’s revenues rose by 1.6 percent to €3.8 billion (previous year: €3.8 billion). Especially due to challenges in individual markets and sectors as well as high start-up costs for new business, operating EBITDA in the reporting period was down by 10.0 percent to €320 million (previous year: €356 million). The EBITDA margin was 8.4 percent, after 9.5 percent in the previous year.

In July 2017, Bertelsmann Chairman and CEO Thomas Rabe and Bertelsmann CFO Bernd Hirsch took over the management of the Arvato division.

Revenues of the Solution Group Arvato CRM Solutions grew slightly in the financial year, but its earnings declined. The main reasons for this were declining business volumes in the telecommunications sector, start-up costs for new clients and the expansion of business with international companies from the IT/high-tech sector. The international network was expanded with the opening of new offices, including in the Philippines and Senegal.

Arvato SCM Solutions massively expanded its global logistics network in the past financial year, reflecting its good order-book situation. In Germany, the United States, France, Austria and Poland, new distribution centers took up operations and some existing sites were expanded, including in the Netherlands and Germany. The Solution Group also expanded its services businesses, primarily in the core sectors of e-commerce, fashion & beauty, and healthcare, and significantly strengthened its North American business by taking over US deliveries for a major high-tech client. The start-up costs for these new business activities impacted earnings.

Arvato Financial Solutions’ financial services businesses did well in terms of both revenues and earnings. Its continued positive business performance was fueled primarily by the steadily growing business in the core market of Germany. To expand the service portfolio in the innovative fintech sector, Arvato Financial Solutions began a collaboration with Solaris Bank. In addition, the shareholding in the Brazilian financial services company Intervalor was increased from 41.5 percent to 81.5 percent.

Demand for Arvato Systems’ IT services remained high in 2017. To sustainably meet this demand, a nearshore site in Riga was opened, among other things. The expansion of business activities in the field of healthcare IT was successfully advanced, and further investments were made in emerging fields such as solutions for the smart-energy market and cloud services. In particular, the project costs for expanding the cloud capabilities had a negative impact on earnings.

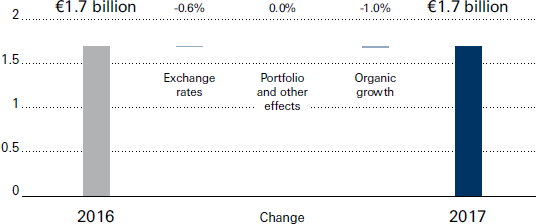

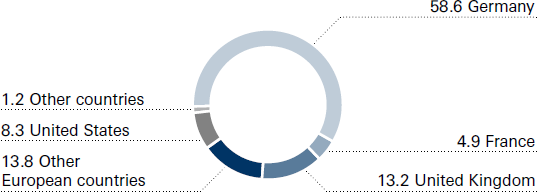

Bertelsmann Printing Group

In the 2017 financial year, the Bertelsmann Printing Group recorded a slight decline in revenue to €1.7 billion (previous year: €1.7 billion, -1.6 percent) and in operating EBITDA, which dipped slightly by 2.3 percent to €118 million (previous year: €121 million). The reason for these changes is the continuing decline in the printing market. At 7.0 percent, the Group’s EBITDA margin is on par with the previous year’s level of 7.1 percent.

The Bertelsmann Printing Group’s offset printing business grew slightly in the 2017 financial year, and achieved a good result. Mohn Media was able to renew important customer contracts during the course of the year, including in the retail sector. GGP Media, a company specializing in print solutions for book publishers, successfully defended its position in a competitive market environment, as did the BPG subsidiary Vogel Druck, which specializes in magazines and catalogs with small to medium-size print runs.

The gravure printing activities bundled in the Prinovis Group declined slightly overall due to difficult market conditions. In the United Kingdom, the business with the major customers acquired in 2016 was expanded. The German Prinovis sites suffered from chronic volume declines, especially in the magazine segment. This decline was countered by an extensive efficiency and cost reduction program, which was completed at the three German sites during the course of the year.

The Bertelsmann Printing Group’s US printing companies faced intense competition in the book printing business. Significant declines in paperback production were at least partially offset by an expansion of the business outside the publishing sector. The US printers’ operating results were below the previous year’s level.

Revenues at Sonopress rose slightly despite difficult market conditions in Mexico. At the Gütersloh headquarters, the company once again bucked the overall market trend by increasing its production volumes, revenues and earnings. Among other things, this development is due to sales successes, also as a result of further market consolidation in Europe. During the year under review, Sonopress also further expanded the production of UHD Blu-ray discs.

The print-related marketing services businesses, which were assigned to the Bertelsmann Printing Group since January 2017, offer cross-channel communication services, especially for the retail segment. These businesses showed a stable overall development due to, among other things, the expansion of digital direct-marketing solutions and the extension of important customer contracts.

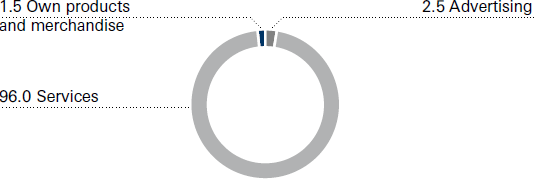

Bertelsmann Education Group

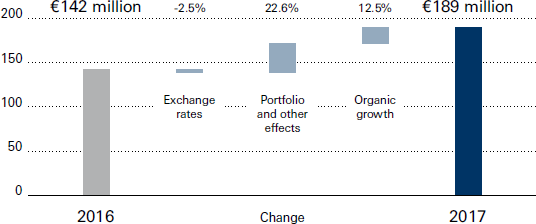

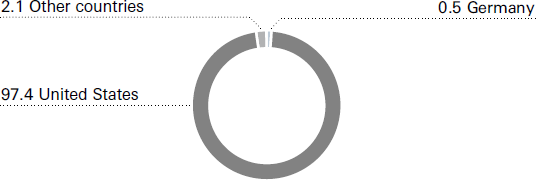

Bertelsmann’s education holdings, pooled in the Bertelsmann Education Group, continued their expansion last year. With their focus on the e-learning (health and technology) and education services sectors, they recorded overall growth both in revenues and earnings during the reporting period. The revenues of Bertelsmann’s fully consolidated companies increased significantly in the past financial year, by 32.6 percent to €189 million (previous year: €142 million). Operating EBITDA rose to €3 million (previous year: €-17 million), mainly due to the successful development of the e-learning provider Relias and lower start-up and transformation costs in other businesses. The EBITDA margin was 1.8 percent (previous year: -11.6 percent).

Relias, currently the most profitable business in the Bertelsmann Education Group, recorded significant growth, continued its expansion path during the reporting period, and grew both organically and through acquisitions. The company expanded its client base to more than 6,500 institutions, whose employees completed about 32.8 million online courses in 2017. Through the acquisition of the US company WhiteCloud Analytics, the Bertelsmann subsidiary further expanded its expertise in the fields of analytics and performance management, thereby expanding its existing business fields.

In collaboration with industry leaders, the online learning provider Udacity launched several new Nanodegree programs, focusing on in-demand skills in innovative fields such as deep learning, digital marketing and software development for robotics. Udacity further expanded its international growth activities; the number of paying students on Udacity programs increased to approximately 50,000. Bertelsmann is one of Udacity’s largest shareholders.

Bertelsmann Investments

The Group’s four funds that comprise the Bertelsmann Investments division further expanded their global network of shareholdings in international start-ups in 2017. Bertelsmann Asia Investments (BAI), Bertelsmann Brazil Investments (BBI), Bertelsmann India Investments (BII) and Bertelsmann Digital Media Investments (BDMI) made a total of more than 40 new investments while also completing several exits, so that Bertelsmann held shares in over 160 companies through its corporate funds at year-end. Across all funds, the focus was on investments in lines of business that are very relevant for the Group, such as digital media offerings, e-commerce services, fintech and education.

Bertelsmann Investments’ business performance is essentially measured by EBIT, which at €141 million significantly exceeds the previous year’s figure of €35 million. Capital gains from divestments once again made a positive contribution to Group profit in the past financial year.

In China, BAI made 29 new investments during the reporting period, and seven follow-on investments, including in the bike-sharing app Mobike and mobile commerce services provider SEE. For the first time, four BAI holdings went public in a single year. In 2017, the premium lifestyle platform Secoo, the fintech company Lexin and the digital marketing platform iClick debuted on the New York technology exchange Nasdaq, and the online automobile retail transaction platform Yixin Group on the Hong Kong Stock Exchange.

In India, BII strengthened its education market activities by investing in the education company Eruditus Executive Education, which develops courses with global Ivy League universities. BII also made six follow-on investments, including in Treebo, a marketplace for budget hotels, and the fintech start-up Lendingkart, which brokers online loans to small and medium-sized companies in more than 900 cities.

In Brazil, BBI continued the establishment of a university network focusing on healthcare education and training with its partner Bozano Investimentos, and increased its stake in Medcel, a provider of online preparatory courses for medical students.

During the reporting period, BDMI made eleven new investments, including in the video company Wibbitz and the charity platform Omaze. At the same time, the fund made several follow-on investments, including in the next-generation publisher Clique Media.

Through their work, all the funds helped to identify innovative and digital trends for the Group and further strengthen Bertelsmann’s position as an attractive business partner. Since 2012, the four investment funds have collectively invested more than €600 million in future-oriented companies.