Net Assets and Financial Position

Financing Guidelines

The primary objective of Bertelsmann’s financial policy is to achieve a balance between financial security, return on equity and growth. For this, Bertelsmann bases its financing policy on the requirements of a “Baa1/BBB+” credit Rating and the associated qualitative and quantitative criteria. Credit ratings and capital market transparency make a considerable contribution to the company’s financial security and independence.

In accordance with the Group structure, the capital allocation is made centrally by Bertelsmann SE & Co. KGaA , which provides the Group companies with liquidity and manages the issuance of guarantees and letters of comfort for them. The Group consists largely of a single financial unit, thereby optimizing capital procurement and investment opportunities.

Bertelsmann utilizes a financial control system employing quantitative financial targets concerning the Group’s economic debt and, to a lesser extent, its capital structure. One of the financial targets is a dynamic leverage factor limited to the defined maximum of 2.5. As of December 31, 2017, the leverage factor of Bertelsmann was 2.5, (December 31, 2016: 2.5), which is in line with the previous year’s level (see further explanation in the “Alternative Performance Measures” section).

As of December 31, 2017, economic debt increased to €6,213 million from €5,913 million in the previous year, due to an increase in net financial debt. The latter increase to €3,479 million (December 31, 2016: €2,625 million) is largely attributable to the financing of the shareholding increase in Penguin Random House. Provisions for pensions and similar obligations fell to €1,685 million as of December 31, 2017 (December 31, 2016: €1,999 million), due to an increase in the interest rate.

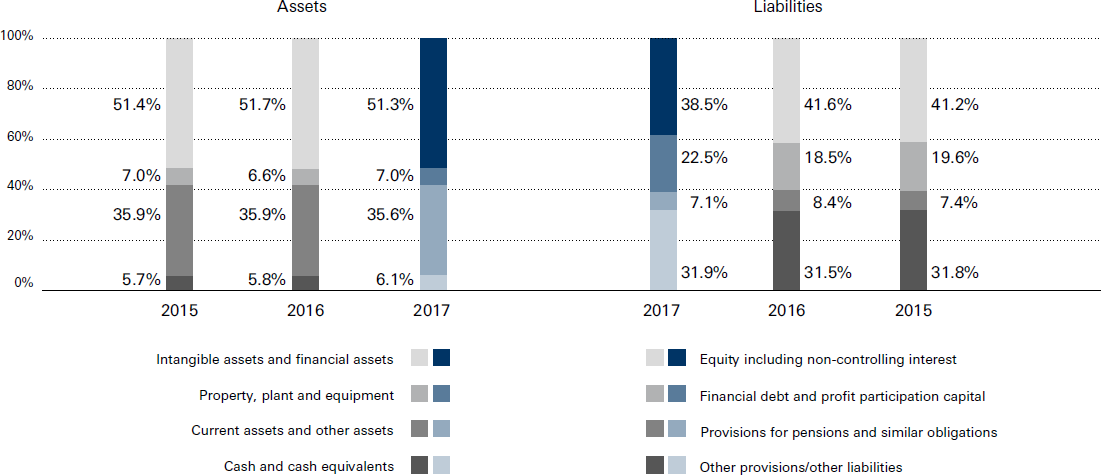

Another financial target is the coverage ratio. This is calculated as the ratio of Operating EBITDA (after modifications) to financial result, which is used to determine the leverage factor and is supposed to be above four. In the reporting period, the coverage ratio was 11.2 (previous year: 9.7). The Group’s equity ratio was 38.5 percent (December 31, 2016: 41.6 percent), which remains significantly above the selfimposed minimum of 25 percent. The decline is attributable to the purchase price payments for increases in shareholdings in the companies that are already fully consolidated, Penguin Random House and SpotX, as well as from dividend distributions to non-controlling interests, which also include the special dividend paid to the co-shareholder as part of the shareholding increase in Penguin Random House.

Financial Targets

Financial Targets

| Target | 2017 | 2016 | |

|---|---|---|---|

| Leverage Factor: Economic debt/Operating EBITDA1) | ≤ 2.5 | 2.5 | 2.5 |

| Coverage ratio: Operating EBITDA/Financial result1) | > 4.0 | 11.2 | 9.7 |

| Equity ratio: Equity as a ratio to total assets (in percent) | ≥ 25.0 | 38.5 | 41.6 |

| 1) After modifications. | |||

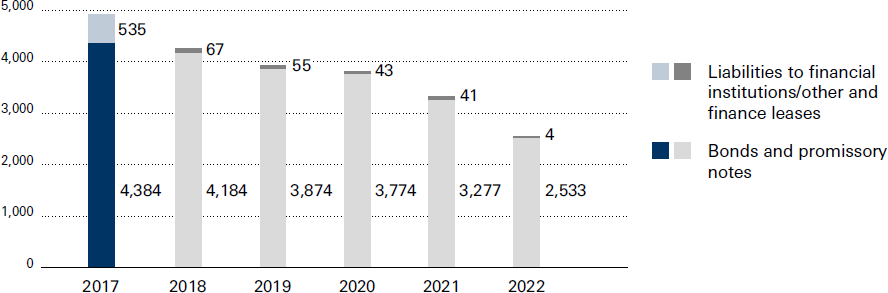

Financing Activities

In May 2017, Bertelsmann placed a bond with a four-year term and an issue volume of €500 million. The bond, which is listed in Luxembourg, has a fixed 0.25 percent coupon. In addition, Bertelsmann issued in the form of private placements in July 2017 a bond in the amount of €50 million with a seven-year term and in August 2017 a promissory note in the amount of €150 million with a term of a year and a half. The proceeds from the placements were primarily used to finance the shareholding increase in Penguin Random House.

Rating

Bertelsmann has been rated by the rating agencies Moody’s and Standard & Poor’s (S&P) since 2002. The agency ratings facilitate access to the international capital markets and are therefore a key element of Bertelsmann’s financial security. Bertelsmann is rated by Moody’s as “Baa1” (outlook: stable) and by S&P as “BBB+” (outlook: stable). Both credit ratings are in the investment-grade category and meet Bertelsmann’s target rating. Bertelsmann’s short-term credit quality rating is “P-2” from Moody’s and “A-2” from S&P.

Credit Facilities

As well as its existing liquidity, the Bertelsmann Group has access to a syndicated loan agreement with major international banks. This forms the backbone of the strategic credit reserve; Bertelsmann can utilize this with a term until 2021 to draw up to €1.2 billion of revolving funds in euros, US dollars and pounds sterling.

Cash Flow Statement

In the reporting period, Bertelsmann generated net cash from operating activities of €1,642 million (previous year: €1,954 million). The Group’s long-term operating free cash flow adjusted for non-recurring items was €1,822 million (previous year: €1,799 million), and the cash conversion rate was 92 percent (previous year: 93 percent); see also “Broadly Defined Performance Indicators” section. The cash flow from investing activities was €-797 million (previous year: €‑1,081 million). This included investments in intangible assets, property, plant and equipment, and financial assets of €‑890 million (previous year: €‑962 million). The purchase price payments for consolidated investments (net of acquired cash and cash equivalents) were €‑213 million (previous year: €‑278 million). Proceeds from the sale of subsidiaries and other business units and from the disposal of other non-current assets were €343 million (previous year: €192 million). Cash flow from financing activities was €-755 million (previous year: €-793 million). Dividends paid to the shareholders of Bertelsmann SE & Co. KGaA remained unchanged at €‑180 million (previous year: €‑180 million). Dividends to non-controlling interests and further payments to partners in partnerships came to €‑743 million (previous year: €‑388 million). This figure includes a special dividend of €373 million paid to the co-shareholder as part of the shareholding increase in Penguin Random House. As of December 31, 2017, Bertelsmann had cash and cash equivalents of €1.4 billion (previous year: €1.4 billion).

Consolidated Cash Flow Statement (Summary)

| in € millions | 2017 | 2016 | |

|---|---|---|---|

| Cash flow from operating activities | 1,642 | 1,954 | |

| Cash flow from investing activities | (797) | (1,081) | |

| Cash flow from financing activities | (755) | (793) | |

| Change in cash and cash equivalents | 90 | 80 | |

| Exchange rate effects and other changes in cash and cash equivalents | (24) | (14) | |

| Cash and cash equivalents on 1/1 | 1,376 | 1,310 | |

| Cash and cash equivalents on 12/31 | 1,442 | 1,376 | |

| Less cash and cash equivalents included within assets held for sale | (2) | (3) | |

| Cash and cash equivalents on 12/31 (according to the consolidated balance sheet) | 1,440 | 1,373 | |

Off-Balance-Sheet Liabilities

The off-balance-sheet liabilities include contingent liabilities and other financial commitments, almost all of which result from operating activities conducted by the divisions. Off-balance-sheet liabilities declined year on year. The off-balance-sheet liabilities in place as of December 31, 2017, had no significant negative effects on the Group’s net assets, financial position and results of operation for the past or for the future financial year.

Investments

Total investments including financial debt acquired of €14 million (previous year: €6 million) amounted to €1.117 million in the financial year 2017 (previous year: €1,244 million). Investments according to the cash flow statement amounted to €1,103 million (previous year: €1,240 million). As in previous years, the majority of the €360 million investment in property, plant and equipment (previous year: €326 million) stemmed from Arvato. Investments in intangible assets came to €319 million (previous year: €388 million) and were primarily attributable to RTL Group for investments in film rights and to BMG for the acquisition of music catalogs. The sum of €211 million was invested in financial assets (previous year: €248 million). These include, in particular, the investments of Bertelsmann Investments. Purchase price payments for consolidated investments (less acquired cash and cash equivalents) totaled €213 million in the reporting period (previous year: €278 million) and were attributable, among other things, to BMG’s acquisition of BBR Music Group.

Taking into account purchase price payments for increases in shareholdings in companies that are already fully consolidated, in particular for the shareholding increase in Penguin Random House and the acquisition of SpotX, the economic investments in the financial year 2017 increased to €1,776 million in total (previous year: €1,262 million). According to IFRS , these payments for increases in shareholdings are classified as change in equity and allocated to cash flow from financing activities. From a company point of view, these payments are, in substance, comparable to purchase price payments for consolidated investments and are thus considered as investments.

Investments by Division

| in € millions | 2017 | 2016 |

|---|---|---|

| RTL Group | 308 | 353 |

| Penguin Random House | 80 | 36 |

| Gruner + Jahr | 38 | 112 |

| BMG | 157 | 183 |

| Arvato | 285 | 167 |

| Bertelsmann Printing Group | 40 | 49 |

| Bertelsmann Education Group | 78 | 175 |

| Bertelsmann Investments | 114 | 147 |

| Total investments by division | 1,100 | 1,222 |

| Corporate/Consolidation | 3 | 18 |

| Total investments | 1,103 | 1,240 |

Balance Sheet

Total assets amounted to €23.7 billion as of December 31, 2017 (previous year: €23.8 billion). Cash and cash equivalents amounted to €1.4 billion (previous year: €1.4 billion). Equity declined to €9.1 billion (previous year: €9.9 billion). The decline is primarily attributable to changes in equity due to the shareholding increase in Penguin Random House and the payment of a special dividend to the co-shareholder. This resulted in a decrease of the equity ratio to 38.5 percent (previous year: 41.6 percent). Equity attributable to Bertelsmann SE & Co. KGaA shareholders was €7.8 billion (previous year: €7.9 billion). Provisions for pensions and similar obligations fell to €1,685 million (previous year: €1,999 million) due to an increase in the interest rate. Gross financial debt increased to €4,919 million compared to €3,998 million as of December 31, 2016, due to the taking up of financial debt as reported in the “Financing Activities” section. Apart from that, the balance sheet structure remained largely unchanged from the previous year.

Profit Participation Capital

Profit participation capital had a par value of €301 million as of December 31, 2017, which is unchanged from the previous year. If the effective interest method is applied, the carrying amount of profit participation capital was €413 million as of December 31, 2017 (previous year: €413 million). The 2001 profit participation certificates (ISIN DE0005229942) account for 94 percent of par value of profit participation capital, while the 1992 profit participation certificates (ISIN DE0005229900) account for the remaining 6 percent.

The 2001 profit participation certificates are officially listed for trading on the Regulated Market of the Frankfurt Stock Exchange. Their price is listed as a percentage of par value. The lowest closing rate of the 2001 profit participation certificates in the financial year 2017 was 316.00 percent in January; their highest was 339.40 percent in November.

Under the terms and conditions of the 2001 profit participation certificates, the payout for each full financial year is 15 percent of par value, subject to the availability of sufficient Group profit and net income at the level of Bertelsmann SE & Co. KGaA. These conditions were met in the past financial year. Accordingly, a payout of 15 percent of the notional value of the 2001 profit participation certificates will also be made for the financial year 2017.

The 1992 profit participation certificates, approved for trading on the Regulated Market in Frankfurt, only have a limited cash trade due to their low volume. Payouts on the 1992 profit participation certificates are based on the Group’s return on total assets. As the return on total assets for the financial year 2017 was 7.73 percent (previous year: 7.09 percent), the payout on the 1992 profit participation certificates for the financial year 2017 will be 8.73 percent of their notional value (previous year: 8.09 percent).

The payout distribution date for both profit participation certificates is expected to be May 15, 2018. Under the terms and conditions of the profit participation certificates, the auditors appointed by Bertelsmann SE & Co. KGaA are responsible for verifying whether amounts to be distributed have been calculated correctly. The auditors of both profit participation certificates provide confirmation of this.